Unveiling the Impact: How Google Financing Can Influence Your Credit Score

In the intricate world of personal finance, the question often arises: does Google financing affect credit score? This inquiry is more than a mere curiosity; it reflects the growing intersection between technology, online services, and individual creditworthiness. In this comprehensive exploration, we, as your financial guides, delve into the nuanced relationship between Google financing and credit scores, providing valuable insights to empower your financial decisions.

Understanding the Dynamics

Decoding Google Financing

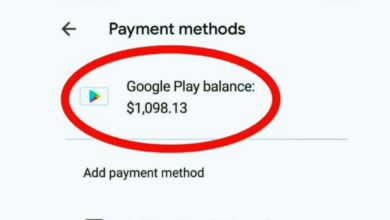

Google Financing is a service that allows users to finance purchases made through Google. This service, often utilized for high-ticket items like smartphones or other electronic devices, provides an alternative payment option beyond traditional methods.

The Credit Score Connection

The influence of Google financing on your credit score hinges on the nature of the transaction. Unlike traditional credit cards or loans, Google Financing typically falls under the umbrella of "point of sale" financing, which may have different implications for your credit history.

Impact on Credit Scores: A Closer Look

1. Point of Sale Financing

Google Financing, being a point of sale financing option, may have a distinct impact on your credit score. Unlike traditional credit accounts, these financing options might not be reported to the major credit bureaus in the same manner.

2. Credit Inquiries

When you opt for Google Financing, it may involve a credit inquiry, a common practice to assess your creditworthiness. While this inquiry may have a minor and short-term impact on your credit score, it's crucial to understand that the effect is usually minimal.

3. Responsible Use and Repayment

Your actions post-financing play a pivotal role. Responsible use and timely repayment of the financed amount contribute positively to your credit history. Conversely, defaults or late payments may have adverse effects.

Navigating the Google Financing Landscape

1. Understanding Terms and Conditions

Before diving into Google Financing, it's imperative to understand the terms and conditions associated with the specific financing option. Familiarize yourself with interest rates, repayment periods, and any potential fees.

2. Assessing Personal Financial Health

Consider how Google Financing aligns with your overall financial health. Assess your budget, existing credit obligations, and whether this financing option complements your financial goals.

3. Exploring Alternatives

While Google Financing offers convenience, it's wise to explore alternative financing options. Compare interest rates, terms, and potential impacts on your credit score before making a decision.

Addressing Common Concerns

1. Privacy and Security

Users often express concerns about the privacy and security of their financial information. Google has robust security measures in place, and transactions are secured using encryption protocols, ensuring the confidentiality of your data.

2. Customer Support and Assistance

For any queries or concerns about Google Financing and its impact on your credit score, reaching out to Google's customer support can provide clarity. They can guide you through the specifics of your financing arrangement.

Future Trends and Google's Commitment

Innovation in Financial Services

As technology evolves, so does the landscape of financial services. Google remains committed to innovation, and future iterations of Google Financing may come with enhanced features and user-centric benefits.

Conclusion: Empowering Informed Financial Choices

In conclusion, the relationship between Google financing and credit score is nuanced, with various factors at play. By understanding the dynamics, assessing personal financial health, and making informed decisions, users can navigate the Google Financing landscape with confidence.